We explain comprehensively which aspects German investors who want to set up a Foreign-Invested Enterprise in China have to consider.

Question 1: What are the common legal forms for a foreign investor who wants to set up a company in China?

The two commonly chosen legal forms are: first, the formation of a Limited Liability Company, e.g., a 100% foreign-invested company or foreign-invested company with a Chinese partner (Sino-German Joint Venture); secondly, the establishment of a representative office of a foreign company.

A Wholly Foreign-Owned Enterprise (WFOE) is the most popular type of company for foreign investors in China. The limited liability company (Co., Ltd.) is the most commonly used legal form (similar to the German GmbH). The shareholders can be foreign natural persons or the foreign parent company. A limited liability company is considered a separate legal entity. The shareholders are liable for the company's debts with their capital contribution.

Question 2: What is the main difference between a representative office, a subsidiary, and a branch office?

The representative office may not engage in direct business activities in China. The main task of the representative office is cooperation with the headquarters overseas in the areas of contact, product promotion, market research, technical exchange, and other business activities. In general, the representative office has only expenses and is not allowed to generate any income. If there is no purchase or sale, there is no tax liability.

A Subsidiary is an independent company that is incorporated, has the status of a legal entity, and is independently liable for civil matters. The parent company is only liable for the amount of its capital contribution. The insolvency of a subsidiary does not affect the parent company. The subsidiary prepares its own accounts and reports the taxes independently.

A branch office does not have the status of a legal entity, i.e., it does not have its own legal personality, and the civil liability arising from it is borne by the parent company. In accordance with the principle of territoriality, Value-Added Tax (VAT) is generally due at the place of operation. Corporate Income Tax (CIT) is consolidated to the parent company and is to be calculated and paid according to the regulations.

Question 3: What should I consider before starting a business?

1. Share capital (subscribed capital)

The minimum share capital for a GmbH in Germany is 25.000€, and a minimum contribution of 50%, i.e., 12.500€, is required at the time of incorporation. The minimum capital requirement of RMB 30.000 (approx. 4.000€) for registration in China has been abolished. In 2014, the "Flexibility when paying in the share capital" system was introduced. It is sufficient that all shareholders undertake to make payment. The share capital does not have to be paid all at once. Still, it can be paid in instalments, with the amount and duration of the payment being determined by the shareholders in the articles of association (AoA). It should be noted that the new "Chinese Company Law" came into effect on July 1, 2024. According to the provisions of the company's articles of association, the shareholders must fully pay their subscribed capital contributions within five years from the date of issuance of the business license.

Unlike in Germany, no capital verification has to be carried out in China as soon as the company's share capital has been paid up.

Shareholders may provide capital contributions by cash or assets/property contributions, or in the forms of intellectual property rights, unpatented technologies, land use rights, and other forms. The price must be evaluated for assets/property contributions, intellectual property rights, unpatented technologies, and land use rights.

Regarding share capital - it is not the lower, the better. Too little share capital affects the credibility of the company for future business. The calculation of the share capital depends on the important expenses for the company's future operation. For trading or service companies, e.g., it is salaries, social security and housing fund, travel expenses, rents, office management fees, service fees, external procurement costs, and working capital. Combining several of these important expenses allows you to estimate how much capital you will need to set aside over the next one to three years.

The German parent company does not have to pay taxes in China when it transfers its share capital. However, the Chinese Subsidiary is subject to stamp duty at 0,025% of the total paid-in capital and capital reserve.

We recommend that the foreign parent company calculates in advance the amount of capital it needs to provide. It is important to know that in China, if a new company makes large purchases during the start-up phase but does not generate any sales for the time being - i.e., if you have more purchases than sales - there is a so-called “excess VAT deduction”, which is carried forward to the next period (unlike in Germany, for newly founded companies, the excess VAT deduction is not paid out by the tax authority according to current regulations, however, the input VAT can reduce the VAT liability and can be carried forward). Thus, when calculating the investment capital of the production company, the German parent company must consider that a high input tax occurs in the start-up phase and plan the VAT credits accordingly over a longer period of time. It should also be taken into account that the investment capital is calculated without VAT refunds.

If the capital is insufficient in the future, it can only be financed by additional investments by shareholders (the subsidiary must go through a capital increase procedure), or the foreign parent company can grant a shareholder loan to the Chinese subsidiary.

Of course, the subsidiary can also apply for a working capital loan from a bank, but it is usually difficult to obtain one if the subsidiary is newly established, small, has no history of profitability, and has no security.

If the subsidiary provides services for the foreign parent company in China and receives a fee for this, e.g., consulting services, the foreign company is subject to Chinese VAT at 6% (if the subsidiary is a general VAT payer). This 6% Chinese Input VAT cannot be offset against the German Output VAT in Germany.

2. The differences between share capital and total investment

In Germany, there is only the concept of share capital, not the concept of total investment. Foreign-invested enterprises in China have both the share capital/registered capital and the total investment (total investment is a specific term for foreign-invested enterprises, there is no such thing for domestic enterprises in China). The difference between the two terms is explained below.

Share Capital: is the total amount of capital registered with the State Administration of Market Regulation Authority for the purpose of incorporation and the sum of the capital contributions payable by the shareholders.

Total Investment: is the sum of the construction funds and the working capital for the production, which must be invested according to the production volume specified in the articles of association. In addition to the share capital, the total investment also includes borrowed capital.

3. Ratio between share capital and total investment1

Total Investment (TI) (in USD millions/M) | Share Capital (SC) or Registered Capital (in percent of the total investment) |

| TI ≤ USD 3 M | Min. 70% |

| USD 3 M < TI ≤ USD 10 M | Min. 50% TI ≤ USD 4,2 M, SC min. USD 2,1 M |

| USD 10 M < TI ≤ USD 30 M | Min. 40%, TI ≤ USD 12,5 M, SC min. USD 5 M |

| TI ≥ USD 30 M | Min. 33,3% TI ≤ USD 36 M, SC min. USD 12 M |

Since neither the "Foreign Investment Law of the PRC" nor the "Regulation for Implementing the Foreign Investment Law of the PRC", which came into force on January 1, 2020, specifically mention that the "Preliminary Provisions on the Ratio of Registered Capital to Total Investment in Sino-Foreign Joint Ventures" will be repealed or maintained, it is recommended to maintain the above ratio of registered capital to total investment for foreign-invested enterprises for future applications to facilitate access to foreign loans (shareholder loans) from abroad (e.g., Germany) as part of the "Borrowing Gap" model.

4. Business Scope

It is advisable to think carefully about the scope of business before registering a new company to avoid changes in later operations since foreign-invested companies are only allowed to engage in the business activities (business scope) specified in the articles of association and business license.

5. Company address

The registration address of the company shall be a commercial or office building. The rental agreement must be available at the time of company name verification.

6. Company Name

Generally, a company name consists of several components: Company name + region + industry + legal form.

Let's take Shanghai as an example, e.g., Robert De (Shanghai) Automation Engineering Co., Ltd., where "Robert De" is the company name, "Shanghai" is the registered place, and "Automation Engineering" is the industry. The company name ends with "Co., Ltd.".

7. The company's management team

The shareholders' meeting is the supreme body of the company.

8. Management of the company

Legal Representative: In the Company Law, the term "Legal Representative" is used. In the vernacular, the term "legal person" is used. There is only one legal representative. The legal representative of the company is appointed in accordance with the provisions of the articles of association by a director or manager who conducts the company's business. The board of directors must consist of at least three persons.

General Manger: In Company Law, the term "Manager" is used, popularly "General Manager". Unlike in Germany, a limited liability company in China only has one registered General Manager who is registered with the local State Administration of Market Regulation Authority.

Supervisor: According to the provisions of the new "Chinese Company Law," companies with a smaller scale or fewer shareholders may forgo the establishment of a supervisory board and instead appoint a single supervisor. In a limited liability company (LLC), the appointment of a supervisory board can be waived with the unanimous consent of all shareholders. Directors and senior management cannot simultaneously serve as supervisors. A supervisory board must consist of at least three members.

9. Differences between the Chinese Legal Representative and the German General Manager

It's easy to confuse the Legal Representative in China with the General Manager in Germany. Thus, we explain their differences below. Unlike in Germany, where one or more General Managers or authorized signatories are named in the German commercial register (HRA), only one Legal Representative is named on the Chinese business license. In addition, Chinese limited liability companies (Co., Ltd.) have only one General Manager who is registered with the local State Administration of Market Regulation Authority. Thus, the Legal Representative, together with the General Manager in China, corresponds to the General Manager in Germany.

Question 4: How long does it take to incorporate a limited liability company in China?

First of all, the German parent company must have its extract from the German commercial register apostilled in Germany. Then in China, you need to pre-register the company name, draft the Articles of Association (AoA), apply for a Business License, register with the Commission of Commerce, order stamps, register with the Customs (if there is import or export), register with the State Administration of Foreign Exchange (SAFE), open bank accounts, transfer the registered share capital from the shareholders, register with the tax authority, open accounts for social security and the housing fund, etc. For non-manufacturing companies, this takes about four to six months.

When you set up a manufacturing enterprise, you also need to go through related assessment procedures, such as energy-saving assessment, environmental impact assessment, safety assessment, occupational disease risk assessment, and other related assessment procedures.

Question 5: What are the specific procedures and steps involved in setting up a company?

The process proceeds in 11 steps:

- Certification (Apostille) of the extract from the commercial register in Germany

- Pre-registration of the company name

- Draft Articles of Association

- Application for Business License

- Registration with the Commission of Commerce

- Stamp making

- Registration with the customs authority

- Registration with SAFE

- Bank account opening, deposit of share capital

- Tax registration

- Opening of the social security and housing fund accounts

1. Certification (Apostille) of the extract from the commercial register in Germany.

The extract from the commercial register (HRA or HRB) of the German parent company must be apostilled, e.g. by the responsible state authority. As a general rule, the Regional Court in the district where the document was issued is responsible for issuing the Apostille. However, since jurisdictions can vary from one federal state to another, it is recommended to inquire with the issuing authority to determine who can provide the "Hague Apostille." In many cases, the processing time is only a few days. The apostille itself has no validity period. However, you should pay attention to the validity period for the commercial register extract. However, it is important to check the validity period of the apostilled documents. Generally, a current commercial register extract should not be older than three to six months.

2. Pre-registration of the company name

The company name must be applied for by the local market supervisory authority. The pre-registration of the company name is valid for two months.

3. Draft articles of association

Unlike in Germany, the articles of association of a newly established company do not have to be certified by a Chinese notary public.

4. Application for a business license

It is not necessary for the legal representative of the new company to travel to China to complete the incorporation process.

The business license for the new company must be applied for by the local market supervision authority. Once the business license is issued, the company is officially established and can begin business activities. For some industries, such as the tobacco industry, pharmaceutical industry and hazardous chemical industry, a separate business license and production registration are also required.

5. Registration with the Commission of Commerce.

According to the "Foreign Investment Reporting Measures"2, as of January 1, 2020, foreign investors or enterprises with foreign investments must report their investment data to the relevant commission of commerce of the place of registration through the enterprise registration system.

6. Stamp manufacturing

Unlike in Germany, there is only one company stamp for a company in China. Chinese enterprises usually have a company stamp, a financial stamp, an invoice stamp, a legal representative stamp, a contract stamp and a customs stamp. The company stamp and legal representative stamp are usually managed by the company's legal representative or general manager, the financial stamp and invoice stamp are usually managed by the finance department, and the contract stamp is usually managed by the business department.

7. Registration with the customs authority

New enterprises engaged in import and export business should also complete the "Declaration of Import and Export Goods" and apply for the Electronic Port Enterprise IC card.

8. Registration with the foreign exchange authority (SAFE)

After obtaining the business license, the new company should apply for Foreign Exchange Registration with the local Foreign Exchange Authority (SAFE). After the foreign exchange registration, the company can open a Capital Contribution Account at a bank with the Foreign Exchange Certificate issued by the foreign exchange authority.

9. Bank account opening, capital contribution account deposit

The new company can then open business accounts at a local Chinese bank or a branch of a foreign bank in China. Unlike the business account in Germany, each business account in China has its own purpose. Commonly used business accounts include the Capital Contribution Account, the Foreign Loan Account, the Basic Deposit Account and the General Deposit Account (also called Settlement Account).

Capital Contribution Account: refers to RMB or foreign currency accounts (e.g. in USD or EUR). The Capital Contribution Account is available only to foreign enterprises and is a special account for the transfer of registered capital stock by foreign (German) shareholders, which is set up at the local bank with a Foreign Exchange Certificate issued by the State Administration of Foreign Exchange (SAFE). Once the capital account is opened, foreign (German) shareholders can transfer their registered share capital.

The Foreign Loan Account: refers to RMB or foreign currency accounts (including in USD or EUR), e.g. an account opened by a company to take out a shareholder loan.

Basic RMB Deposit Account: Only one basic RMB account can be opened for a company, which must also be approved by the People's Bank of China. Generally, all cash withdrawals, tax payments, social security payments and payments to government agencies are made through the basic account. The basic account is also the only business account from which cash can be withdrawn.

General Deposit Account or Settlement Account: refers to RMB or foreign currency accounts (e.g. in USD or EUR). The RMB General Deposit Account shall be opened at a bank other than the bank where the Basic Deposit Account was opened. Companies may open multiple general accounts.

Due to the uncertainty of exchange rate fluctuations, in order to reduce the risk of exchanging Euros or US dollars for RMB, it is recommended that enterprises with many import and export transactions open a foreign currency clearing account so that Euros received from abroad can be exchanged for RMB when the exchange rate is high.

The difference between a basic account and a general account is that cash cannot be withdrawn through a general account.

Note: Within 15 days after opening the RMB base account or other business accounts, the new enterprise should register all business accounts in written form with the local tax office.

10. Tax Registration

Within 30 days of obtaining the business license, the new business must apply to the local tax office for tax registration and general VAT taxpayer registration, and submit the financial and accounting system or financial and accounting software to the tax office for registration.

Since the requirements vary from city to city, it is advisable to check in advance with the local tax office whether the legal representative and the person responsible for the financial affairs of the new company must first be guaranteed by their real names (real-name authentication). The tax office will check the tax and invoice types (Fapiao) depending on the industry, size of the company and scope of business.

The new company must also acquire a Tax UKey, apply for paper VAT invoices (Fapiao) and electronic VAT invoices (Fapiao).

After tax registration, the new company must file tax returns (including zero returns) every month, quarter and year within the prescribed deadlines.

11. Opening social security and housing accounts

Before a company can make Social Security and Housing Fund payments for its employees, it must apply for separate accounts with the Social Security Bureau (HR and Social Security Bureau) and the Housing Fund Management Center to store Social Security and Housing Fund information separately for the company's employees. Only after the accounts are opened, the company can provide the five branches of Social Security and Housing Fund for its employees accordingly.

Question 6: What are the main tax types and rates in China?

1. Value-Added Tax (VAT)

As in Germany, VAT in China is based on the net price of goods or services and is levied at four rates of 13%, 9%, 6% and 0% for general VAT tax-payers, and at two rates of 5% and 3% (1%) for small-scale VAT tax-payers, depending on the taxable business activity. Strictly speaking, VAT is not a tax burden on businesses, as the actual bearer of VAT is the final consumer and not the business, which is why VAT is also referred to as sales tax. There are two types of companies as VAT payers: general VAT tax-payers and small-scale VAT tax-payers. An enterprise must register as a general VAT tax-payer if its annual turnover (net) exceeds RMB five million. The annual turnover (gross) of small-scale VAT tax-payers shall not exceed five million.

1.1 VAT tax-payers are entitled to input VAT deduction.

The main tax rates are as follows:

- Sale or import of goods (except those listed at 9%*), provision of processing, repair and replacement services: 13%.

- Installation services, incl. services for installation, assembly and commissioning of machinery: 9%

- Modern services, incl. maintenance of machinery, technical services, consultancy services, training services: 6%

- Export of goods, cross-border services: 0%

*9%: Sales or imports of agricultural products (including grain), water, heating, liquefied petroleum gas, natural gas, edible vegetable oil, cold gas, hot water, gas, coal products for domestic use, table salt, agricultural machinery, animal feed, pesticides, agricultural films, fertilizers and biogas, dimethyl ether, books, newspapers, magazines, audiovisual products, electronic publications

VAT for general tax-payers = Current output VAT - Current input VAT.

- Input VAT = Purchase price (net) x VAT rate

- Output VAT = Sales price (net) x VAT rate

- Sales price (net) = Sales price (gross) / (1 + VAT rate)

Note: If the input VAT from the purchase is greater than the VAT from the sale, the result is an input VAT surplus. In the advance VAT return, the excess deduction is carried forward to the next period. Unlike in Germany, the tax office does not usually pay VAT to newly established companies (except in the case of trading companies with export business).

1.2 Small tax-payers are not eligible for input VAT deduction.

The main tax rates are as follows:

- Sale of goods or provision of services: 3% (reduced by 1% from January 1, 2023, to December 31, 2023)

- Sale of real estate: 5%

VAT of the small tax-payer = sales price (net) x VAT rate

- Sales price (net) = Sales price (gross) / (1 + VAT rate)

2. Surtaxes

Companies that pay VAT are also subject to Surtaxes, which are calculated on the basis of the VAT actually paid.

- City maintenance and construction tax: Cities: 7% (counties: 5%; others: 1%).

- Education surcharge: 3%.

- Local education surcharge: 2%.

Different surcharge rates in different regions

Surtaxes = VAT payable x 12%

Note: Companies that pay consumer tax are also subject to Surtaxes. It is calculated on the basis of the actual consumer tax paid.

2. Corporate Income Tax, Enterprise Income Tax (CIT, EIT)

- Standard rate: 25%.

- High-tech companies: 15%.

- Small and low-income companies: 20%*

- Annual taxable income < 1 million > 3 million RMB: effective CIT: 5% (25% x 20%) until Dec 31, 2024.

*Criteria for small and low-income enterprises:

- Annual taxable income: < RMB 3 million,

- The number of employees: < 300 employees, and

- The total assets: < 50 million RMB.

4. Stamp duty (SD)

Stamp duty is payable by legal entities and individuals who agree/enter into purchase and sale contracts, processing and construction contracts, real estate leasing, goods transportation, storage and custody, loans, property insurance, technical contracts or documents of a contractual nature, property transfer documents, business books, rights and licenses in China.

Tax rates: 0.05%, 0.03%, 0.1%, 0.025% (depending on the contract), 5 RMB.

5. Individual Income Tax (IIT)

Total income is composed of four items: Income from wages and salaries, compensation for personal services, author royalties, and royalties. Progressive tax rates of 3% to 45% apply.

Unlike Germany, China applies the cumulative withholding method, which is characterized by lower payroll taxes at the beginning of the year and higher payroll taxes at the end of the year. Thus, an employee who draws a salary in China receives a higher net salary at the beginning of the year and a lower net salary at the end of the year. This means that an employee in China receives a net salary that fluctuates monthly, while the monthly gross salary remains the same.

Tax Table for Comprehensive Income

| Level | Taxable income RMB/year* | Tax rates | Quick deduction in RMB |

| 1 | < 36.000 | 3% | 0 |

| 2 | 36.001-144.000 | 10% | 2.520 |

| 3 | 144.001-300.000 | 20% | 16.920 |

| 4 | 300.001-420.000 | 25% | 31.920 |

| 5 | 420.001-660.000 | 30% | 52.920 |

| 6 | 660.001-960.000 | 35% | 85.920 |

| 7 | > 960.000 | 45% | 181.920 |

Annotation:

- The annual taxable income mentioned in this table refers to the total income of a Tax Resident of the PRC (individuals) according to Article 6 "of the PRC Individual Income Tax Law"3. The amount of income in each tax year is reduced by RMB 60,000 and special deductions and other deducted balances are determined in accordance with the law.

- Monthly personal Individual Income Tax (IIT) = (Monthly Gross Salary - Lump Sum Deduction of Expenses 5,000 RMB - Employee Contributions to "Social Security and Housing Fund") x Applicable tax rate - Quick Deduction.

- Standard deduction of business expenses 5,000 RMB/month, or 60,000 RMB/year.

- Non-resident taxpayers (individuals) receiving income from wages or salaries, employment compensation, author's fees or royalties shall calculate the taxable amount on a monthly basis and according to this tax table.

Question 7: What are the accounting and tax obligations of a new company after its establishment?

1. Bookkeeping obligations

The new company must register for tax within 30 days of the issuance of the business license. Within the same month, business books should be established and already kept and invoices (Fapiaos: VAT invoices) should be applied for, issued and kept.

The financial and accounting system or the accounting and financial and accounting software of the new company shall be submitted to the tax office for registration.

2. Accounting and tax return obligations

After the preparation of the first monthly financial statement, the tax return is due the following month.

Enterprises that have adopted "China Accounting Standards for Business Enterprises: CAS" should prepare and submit monthly (quarterly) financial reports, including balance sheet, income statement and cash flow statement to the tax office, and file tax returns.

3. Obligation of zero reporting in tax returns

3.1 Sales Tax Zero Reporting

- General VAT tax-payers file a zero return for VAT with the tax office if no VAT and input VAT is incurred in the current period.

- Small-Scale VAT tax-payers may file a zero return for VAT with the Tax Office if the taxable income in the current period is zero.

3.2 Corporate income tax zero return

If the tax-payer does not carry out any business activity in the current period and has no revenues and expenses, a zero CIT return can be filed.

Note: Permanent zero returns affect the company's credit rating. Invoices (Fapiaos, VAT Invoices) will be downgraded and reduced by the tax office, and the company's electronic account will be blocked. If it is not unblocked for three to six months, it will be blacklisted by the tax system and risk having its business license revoked.

4. Obligation to submit advance VAT and Surtax returns on a monthly basis

4.1 General VAT tax-payer

General VAT tax-payers submit their advance VAT tax returns on a monthly basis, with the deadline for submission being the 15th of the following month*.

4.2 Small-Scale VAT Tax Payers

Small-scale VAT payers may submit their advance VAT tax return on a monthly or quarterly basis. For monthly advance VAT returns, the deadline for submission is the 15th of the following month*. For quarterly advance VAT returns, the submission deadline is 15 days after the end of each quarter*.

Note: In Germany, there is an annual VAT return. In China, there is no annual VAT return.

4.3 Surtaxes

The taxpayer is also required to file an advance return for surtaxes when filing the advance return for VAT.

5. Reporting obligations for stamp duty (SD).

Stamp duty is filed monthly and the filing deadline is the 15th of the following month*.

6. Monthly income tax declaration obligation

When a company pays wages to its employees, the employer deducts IIT (called "Lohnsteuer" in Germany) directly from the employee's gross salary each month and pays it to the tax office on a monthly basis. The deadline for submission is the 15th of the following month*.

7. Obligation to submit (monthly) quarterly advance corporate income tax returns

CIT is payable (monthly) quarterly in advance and is credited in total at the end of the year, with refunds and additional payments. The deadline for filing is 15 days after the end of each (month) quarter*.

*For public holidays and weekends, filing deadlines are postponed.

8. Withholding tax liability

Payments of service fees, royalties, interest, dividends and profit distributions from a domestic company (China) to a foreign company (Germany) are subject to withholding tax. If the payment amount exceeds USD 50,000, the domestic company must submit the contract (or agreement, with Chinese translation for foreign language contracts) and invoice (Fapiao) to the tax office to declare and remit the tax, and then go to the bank counter with the tax documents, contract and invoice to make the remittance to the foreign country (Germany).

9. Other tax reporting requirements

Environmental protection tax, urban land use tax, land acquisition tax, farmland use tax, land tax, vehicle and ship tax, resource tax, deed tax, etc.

10. Obligation to register the Disabled Persons' Employment Security Fund

Contributions to the Disabled Persons' Employment Security Fund are calculated and paid annually. The reporting period for contributions runs from August 1 to September 30 of each year.

11. Obligations for the preparation of annual accounts and the annual audit of accounts

According to Article 175 of the "Company Law of the People's Republic of China4": the company shall prepare and have audited annual financial statements at the end of each fiscal year.

12. Obligations to file the annual income tax return

The deadline for filing the annual CIT return is May 31 of the following year5. The company shall have prepared or audited the annual financial statements at the latest prior to the filing of the annual CIT return.

13. Disclosure requirements

According to the Foreign Investment Reporting Measures6, each year between January 1 and June 30, foreign-invested enterprises must submit the latest annual report to the relevant provincial Commerce Authorities through the National Enterprise Credit Information Publicity System. It is important to note that the disclosure of the annual report in China is different from the disclosure of the annual financial statements in Germany, via the Federal Gazette. In Germany, the annual financial statements, including balance sheet, income statement and notes, etc., are usually disclosed in the Federal Gazette. Medium-sized companies can make a simplified disclosure of balance sheet, income statement and notes.

In China, the annual report of an enterprise usually includes: basic information about the enterprise, the operation status (such as opening, closing, liquidation, etc. ), the capital contribution of shareholders (the date and amount of capital contribution), whether there is a website or online store, information on transfer of shares, information on investment or acquisition of shares of other enterprises, the assets of the enterprise, information on external guarantees, the number of employees, number of insured employees, SV contribution rate of the employer, details of the company's supplementary information, business volume, total salary costs of all employees, intellectual property rights, investors and their actual responsible persons (natural persons), operations invested abroad, debts and liabilities, tax exemptions for imported equipment, and assets and liabilities.

Question 8: What do foreign-invested enterprises need to consider when applying for a Shareholder loan/Foreign loan?

First of all, a loan agreement must be drawn up, including important terms such as loan amount, currency, interest rate, term, purpose and repayment schedule. This contract should be submitted to the local foreign exchange authority (SAFE) within 15 working days after signing. The contract should be accompanied by a Chinese translation if it is in English or German. The interest rate for the loan should be in line with the market rate in China. After the registration procedure, the company must open a separate shareholder loan account with the local bank. The use of foreign borrowed funds and the repayment of loans and interest are handled through the bank. Foreign-invested enterprises should also submit a copy of the audited financial statements for the previous year or the most recent period.

Foreign-invested enterprises can choose between the "borrowing gap model" and the "full coverage model" when taking out a shareholder loan for the first time. It is advisable to check in advance with the local SAFE authority whether the model once chosen can still be changed.

Under the "borrowing gap model", the maximum amount of corporate loan that the foreign-invested enterprise can borrow is equal to = (total investment - registered equity) x paid-up equity/registered equity.

Under the "full coverage model", the maximum amount of the foreign-invested enterprise's shareholder loan generally cannot exceed 2.5 times* the net assets of the latest audited financial statements (no banks).

*The calculation formula of the "Full Coverage" model is complex, the factor 2.5 serves only as a reference, different currencies and loan terms etc. influence the parameters.

Question 9: What categories do salary costs for employing staff in China consist of?

As in Germany, salary costs in China mainly consist of wages and salaries (gross) and employer contributions to social security (plus approx. 30% of gross wages). The net salary is calculated by deducting the IIT (also called „Lohnsteuer“ in Germany) and employee contributions to social security from the gross salary. As in Germany, the employer in China withholds IIT and employee contributions to social security and the Housing Fund from the employee's salary. The employer then deducts these contributions. The net salary is paid directly to the employee by the company.

Question 10: What does the Chinese social security and housing fund cover?

German social insurance is divided into pension, unemployment, health, occupational accident and long-term care insurance, with occupational accident insurance being paid separately only by the employer. The share of German social insurance is about 40%, with employers and employees each paying half.

The Chinese social insurance system (five insurance branches and the housing construction fund) comprises pension, unemployment, health, occupational accident and maternity insurance as well as the housing construction fund, with occupational accident and maternity insurance being borne separately by the employer only. There is no housing fund in Germany. In China, the employer pays about 30% of the social insurance and the employee pays about 15%.

Please feel free to contact china.desk@bdp-team.de for accounting, tax and legal questions regarding setting up a business in China. Our bdp China Desk Team will be happy to advise and support you.

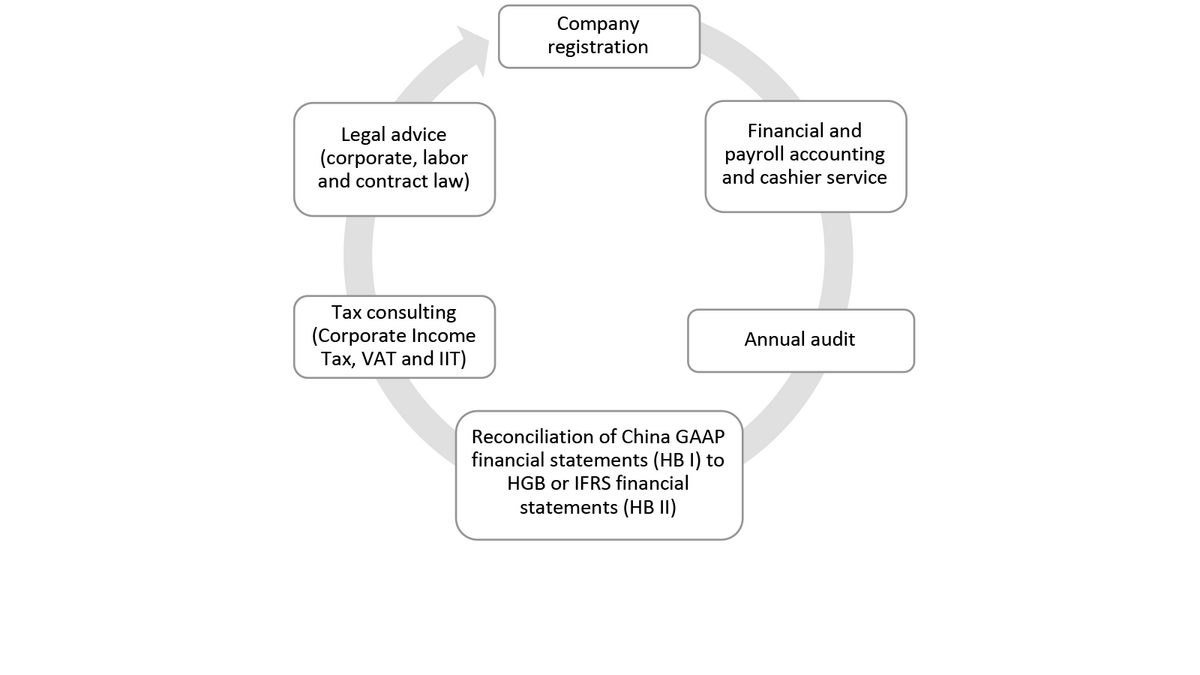

bdp China Desk: One-Stop-Agency for business startups

bdp China Desk: One-Stop-Agency for business startups

Footnotes

1. "Provisional Provisions on the Ratio of Registered Capital to Total Investment in Sino-Foreign Joint Ventures" (1987).

National Development and Reform Commission of the People's Republic of China.

2. "Measures on Foreign Investment Reporting" (2020).

State Administration for Market Regulation and Administration.

3. "Income Tax Law of the People's Republic of China" (2018).

State Taxation Administration.

4. "Company Law of the People's Republic of China" (2004).

Ministry of Commerce of the PRC (PRC).

5. "Administrative measures for the regulation of corporate income tax " (2009)

State Taxation Administration

6. "Measures for Reporting Information on Foreign Investment" (2020).

State Administration for Market Supervision and Administration (State Administration for Market Regulation)

By: Fang Fang (Partner bdp China), Frank Yang (Lawyer), Ricky Ma (Head of Tax Team), Yolanda You (CICPA/ Senior Auditor)

Translation: Fang Fang (Partner of bdp China), Sara Zimmermann (Senior Consultant), Vitus Klatt (Audit Assistant)